Time: 2024-08-12

Time: 2024-08-12  Views: 432

Views: 432

[Foreword]

Decision has been deeply involved in the SAP field for more than 18 years and has been praised by many customers. In order to better help customers implement digital projects, the "Decision Expert Column" is completely free and open source, paying tribute to Musk's open source spirit!

Based on the senior capabilities of Decision's expert consultant team with more than 20 years of SAP experience, combined with Decision's 1,000+ successful project cases, this article summarizes and publishes the corresponding research experience and suggestions of enterprises in promoting ERP project implementation, and continues to escort the SAP implementation and delivery of enterprises.

[Problem Description]

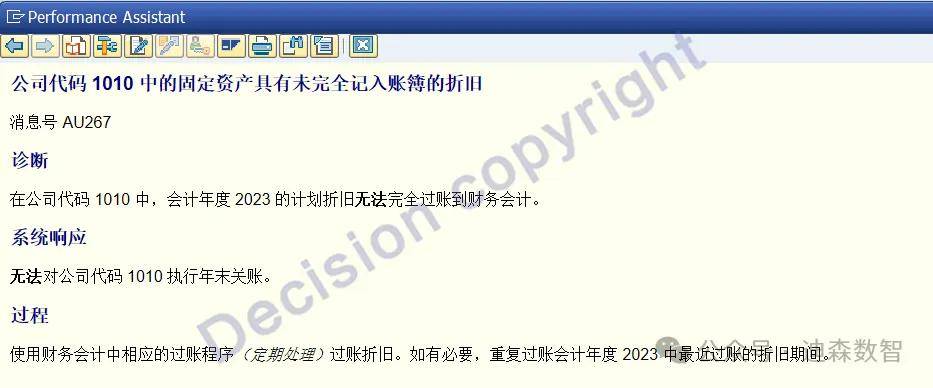

When the transaction code FAA_CMP closes the previous year 2023 of an asset, the system prompts AU267, depreciation is not fully accounted, as shown in the figure below. Which assets have not been depreciated? What is the reason? How to deal with it?

[Problem Analysis]

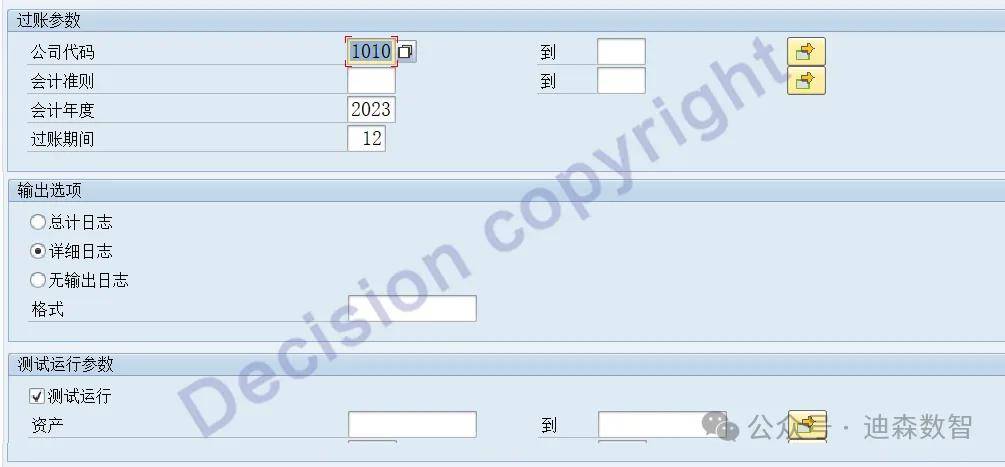

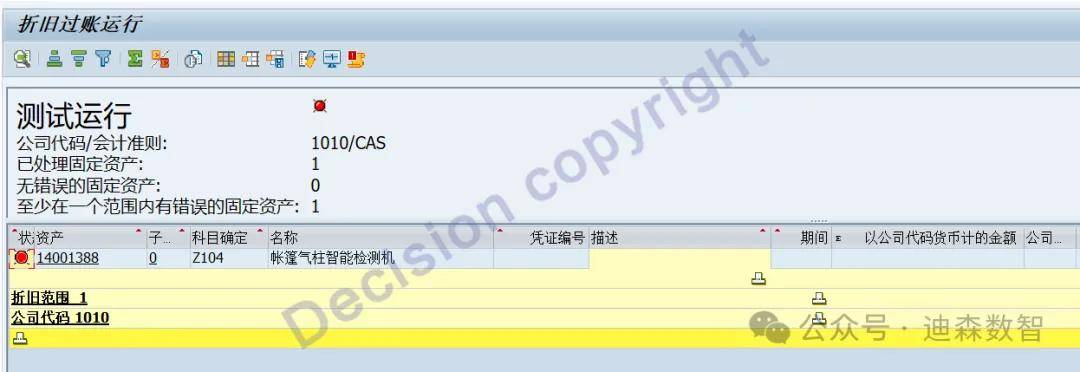

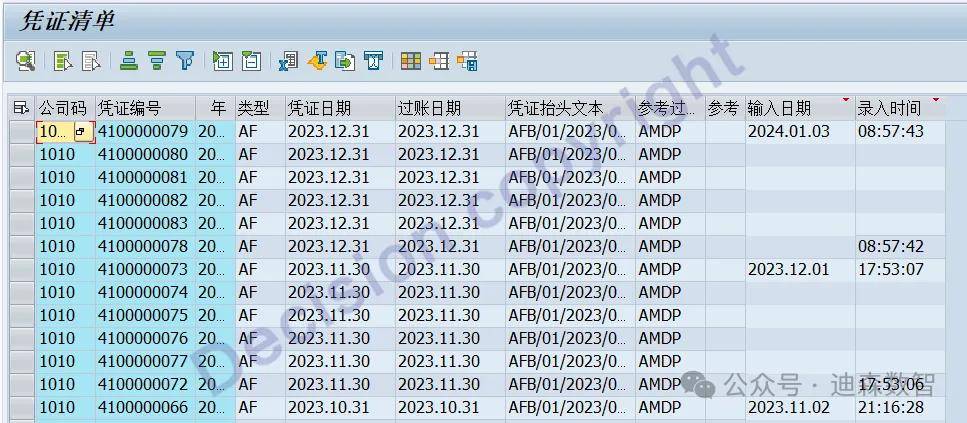

1. Transaction code AFAB simulates the depreciation of the last month of 2023.

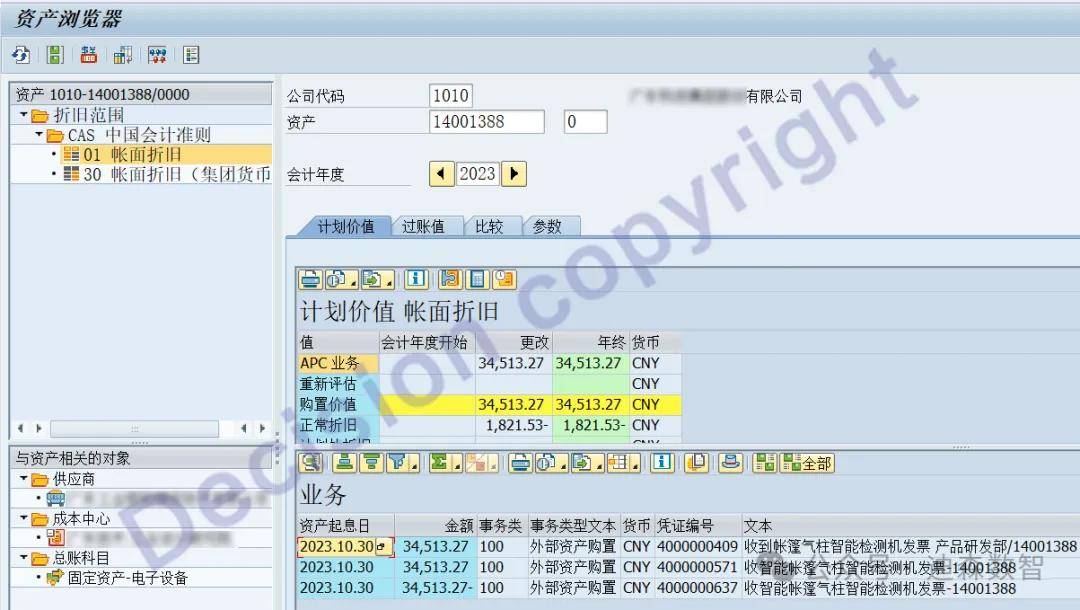

It can be seen that the depreciation of asset 14001388 has not been fully posted.

2. Transaction code AS03, it can be seen that there is indeed an unposted depreciation calculated by the system.

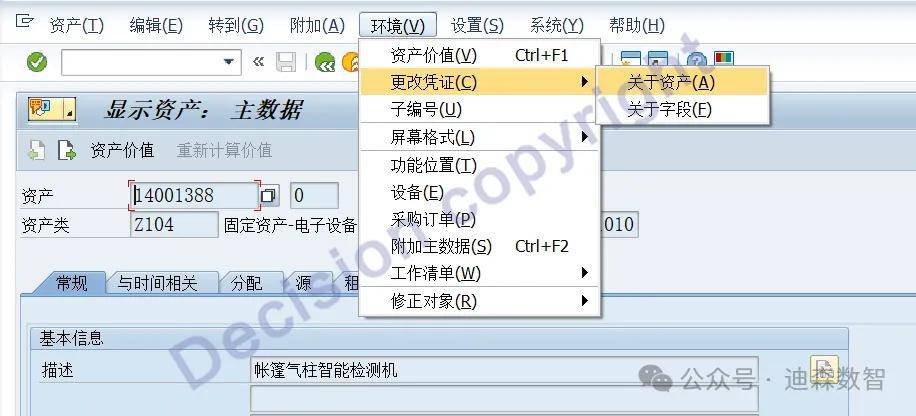

3. Transaction code AS03, check the asset modification log, no log of modifying the depreciation period and depreciation code is found.

4. Transaction code AS03, check the asset modification log, no log of modifying the depreciation period and depreciation code is found.

Of these three original values, the second one 4000000571 is a duplicate entry, and the third one 4000000637 is used to offset the second one 4000000571.

Checking the entry date of the capitalized original value and the entry date of the depreciation posting, it is found that the depreciation in December is exactly between the second and third vouchers,

which leads to the wrong depreciation of this asset in December, and over-depreciation!

The third voucher is a write-off voucher with a capitalization date of 20231030. After the write-off, the asset depreciation is recalculated, so the depreciation amount for 2023 needs to be adjusted to: 1821.54 yuan (depreciation reduction). However, the asset accountant did not check the depreciation of this asset in time, and only calculated the amount of 1821.54 yuan. It has not been actually posted to FI.

[Solution]

1. Considering that the 2023 financial report has been issued and audited, the depreciation amount for 2023 should not be adjusted, so the following processing is performed. (If: the 2023 financial report has not been issued, AFAB can be executed to supplement the depreciation for December 2023)

2. Transaction code ABAA, make a depreciation for 2023 (depreciation increase).

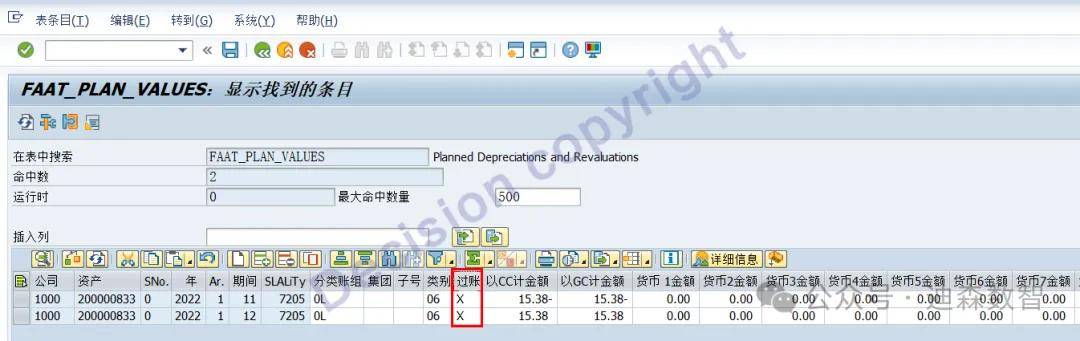

3. The unposted and posted line items of asset depreciation can be queried in the data table FAAV_PLAN_VALUES.

It can be seen that there are exactly two items of planned depreciation and unplanned depreciation in December, one positive and one negative, which have not been posted, and the total amount is zero.

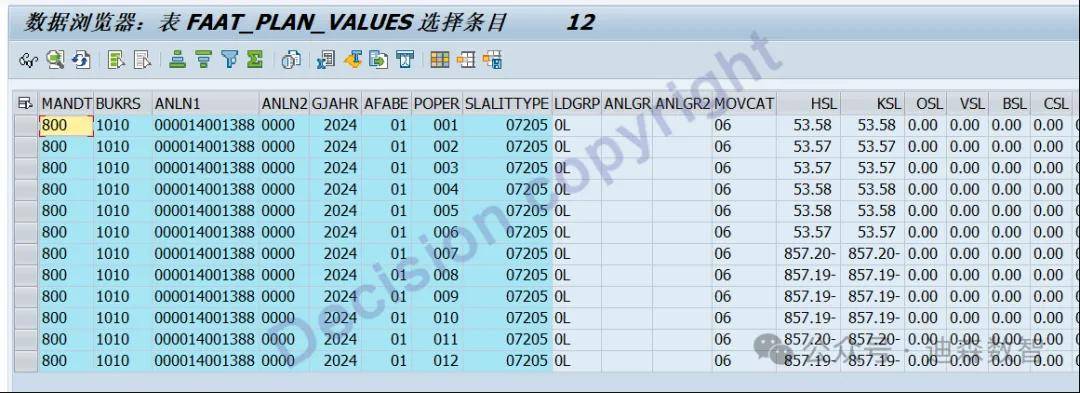

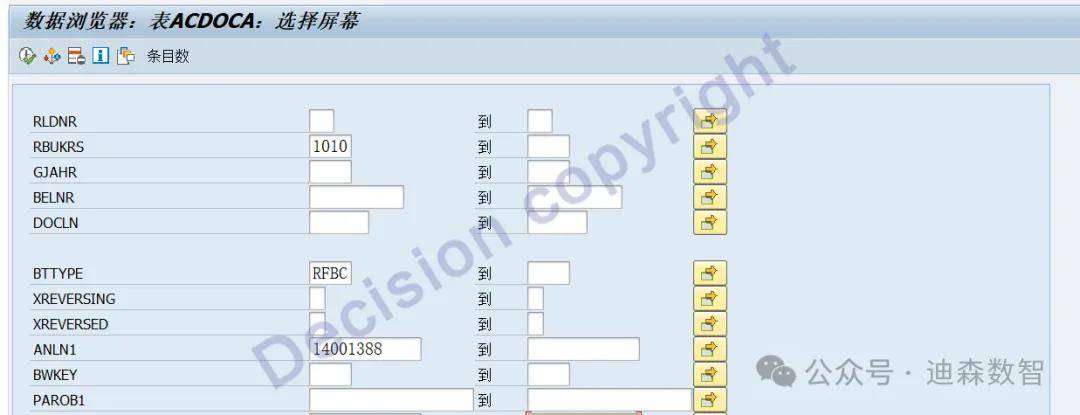

4. Transaction code SE16N, clear the "unposted" mark of the asset's undepreciated amount: FAAT_PLAN_VALUES table

Note that the total undepreciated amount must be zero! Otherwise, the FI general ledger and the asset module detailed data will be inconsistent!

Continue to query the balance carryforward at the beginning of 2024 in the ACDOCA table.

As shown in the figure above, if the balance carryforward automatically includes a positive depreciation and a negative depreciation, there is no need to modify the FAAT_PLAN_VALUES table.

6. Check the depreciation posting of the asset in the previous year with transaction code AS03, and you can see that the unposted data is gone.

7. Transaction code FAA_CMP closes the assets of the previous year.

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Eighteen years of quality, trustworthy!