Time: 2023-10-09

Time: 2023-10-09  Views: 771

Views: 771

[Foreword]

The reason why Decision is highly praised by enterprises during the implementation of digital transformation projects is because experts are escorting Decision during the project process to help enterprises gain new knowledge, grow new capabilities, and improve management during the implementation of digital transformation projects. To improve our vision and reduce project misunderstandings, we have specially set up a "Decision Expert Column" to share with you a series of articles on the implementation of digital transformation projects, so stay tuned.

This article is based on Mr. Yang Yongqing, Decision’s chief financial expert, who has 24 years of rich experience in the field of SAP ERP, and combines the common misunderstandings he found in the implementation of ERP projects to publish corresponding research insights and suggestions to protect your SAP financial implementation and delivery.

[Double declining balance depreciation method (theory)]

①Formula

- Monthly depreciation amount 1 (accelerated depreciation) = net value at the beginning of the year * 2 / years / 12

- Monthly depreciation amount 2 (straight-line depreciation) = (Net value at the beginning of the year - residual value) / 24

- Residual value is not considered;

- Within the same depreciation year (there are cross-financial years/accounting years), the monthly depreciation amount is the same;

- In the last two years (24 months) before maturity, the depreciation method needs to be switched to the direct line method. After deducting the residual value from the remaining net value, depreciation and amortization are carried out on average over 24 months.

[Difficulties in implementation]

① Double declining balance method depreciation is depreciated on an annual basis, that is: (double declining balance method) depreciation year, which is not necessarily the same as the accounting year:

- If the asset is capitalized in December, the depreciation year (double declining balance method) is the same as the accounting year;

- If the asset is capitalized in June, the (double declining balance method) depreciation year is different from the accounting year. (Double declining balance method) depreciation year 1 is from July of the first year to June of the second year of the accounting year. moon;

- If the asset is capitalized in January, the (double declining balance method) depreciation year is different from the accounting year. (Double declining balance method) depreciation year 1 is from February of year 1 to year 2 of the accounting year. moon;

- If the asset is capitalized in July, the (double declining balance method) depreciation year is different from the accounting year. (Double declining balance method) depreciation year 1 is from August of the first year to July of the second year of the accounting year. moon.

③ Double declining balance method depreciation, switching to straight-line depreciation in the last two years, the asset master data needs to be filled in manually or automatically by the system: switch year, switch month.

[SAP system implementation]

Case number one

The asset depreciation year is exactly the same as the accounting year. The asset data is as follows, and the depreciation calculated in the table is as follows:

In this case, the capitalization date of the original value is December 2013, and the depreciation is from January 2014 to December 2018. (Double Declining Balance Method) The depreciation year is the same as the accounting year.

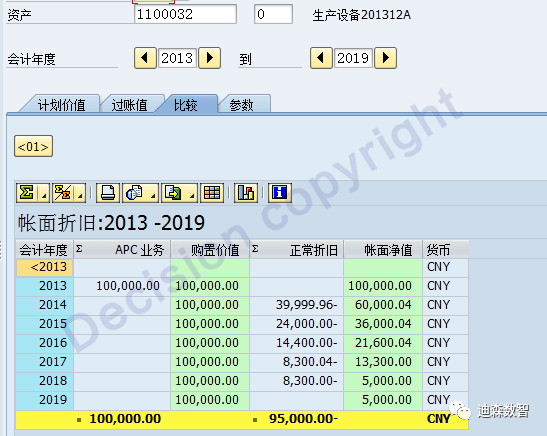

(Case 1) In the SAP system, the depreciation amount realized is basically the same as the table (only a small tail difference):

Case 2

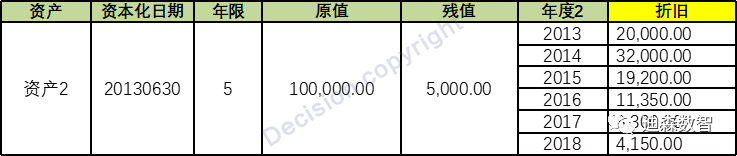

Taking the asset depreciation year and crossing half of the fiscal year (6 months are the same and 6 months are different), the asset data is as follows, and the depreciation calculated in the table is as follows:

In this case, the capitalization date of the original value is June 2013, and the depreciation is from July 2013 to June 2018. (Double Declining Balance Method) The depreciation year is different from the accounting year.

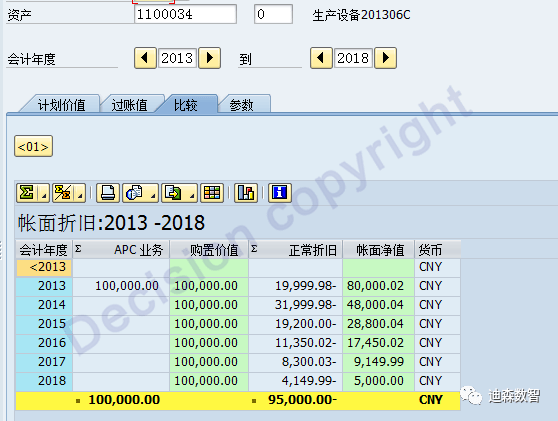

(Case 2) In the SAP system, the depreciation amount realized is basically the same as the table (only a small tail difference):

Case three

Based on the asset depreciation year, which intersects irregularly with the accounting year (11 months are the same and 1 month is different), the asset data is as follows, and the depreciation calculated in the table is as follows:

In this case, the capitalization date of the original value is January 2013, and the depreciation is from February 2013 to January 2018. (Double Declining Balance Method) The depreciation year is different from the accounting year.

(Case 3) In the SAP system, the depreciation amount realized is basically the same as the table (only a small tail difference):

Case 4

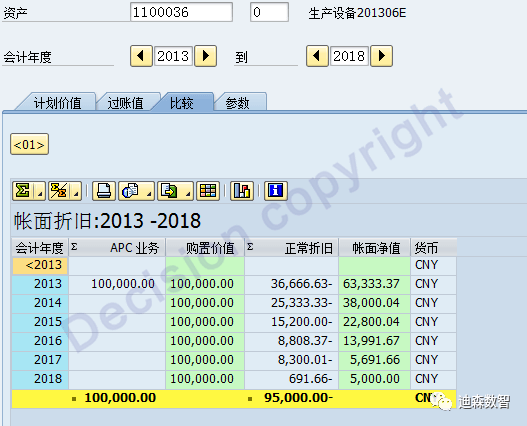

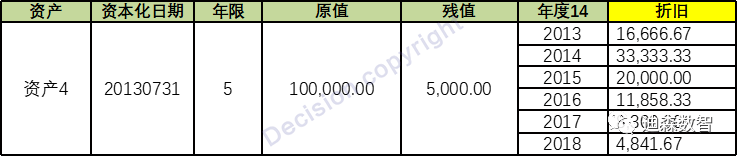

Based on the asset depreciation year, which intersects irregularly with the accounting year (5 months are the same and 7 months are different), the asset data is as follows, and the depreciation calculated in the table is as follows:

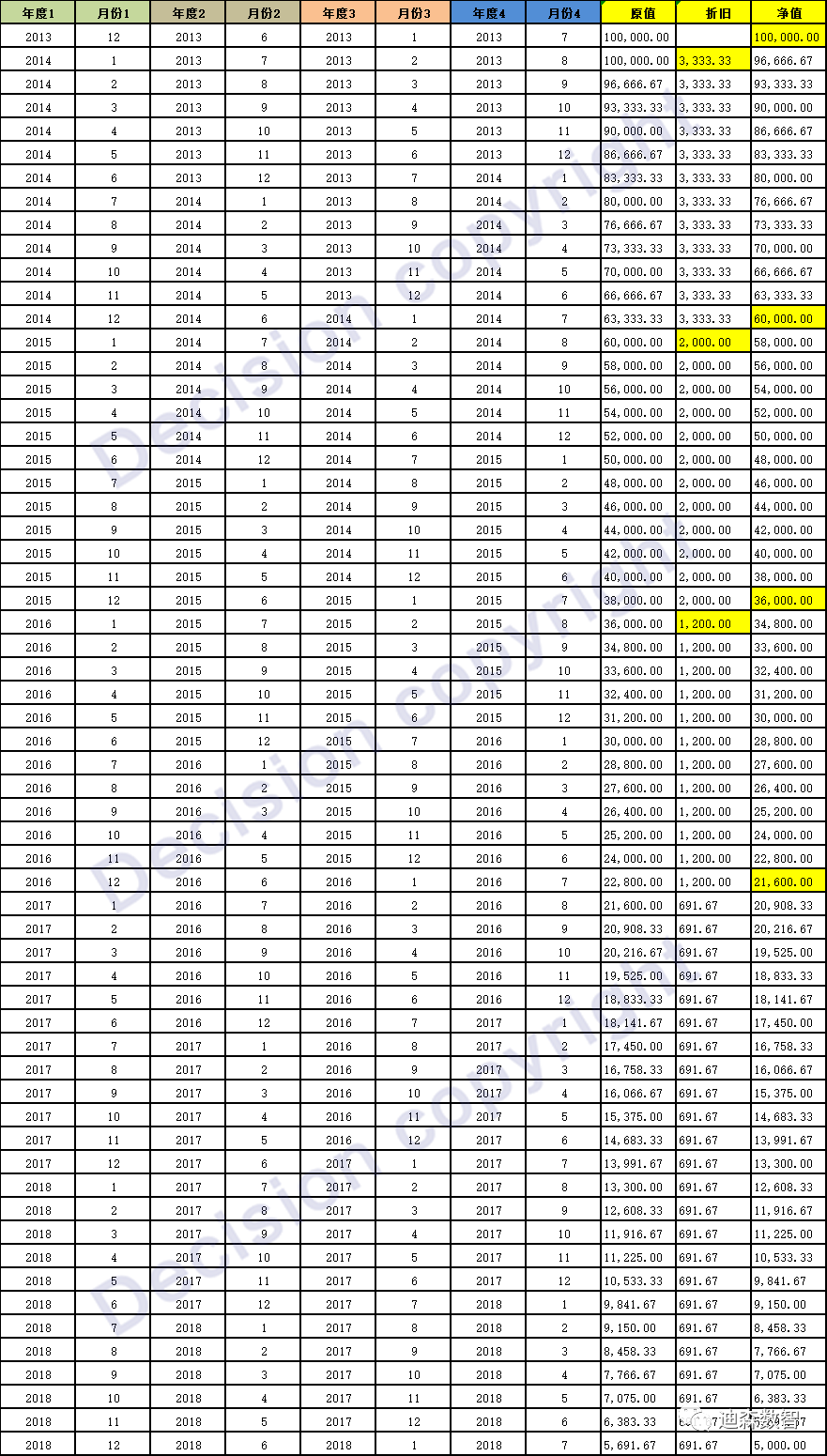

In this case, the capitalization date of the original value is July 2013, and the depreciation is from August 2013 to July 2018. (Double Declining Balance Method) The depreciation year is different from the accounting year.

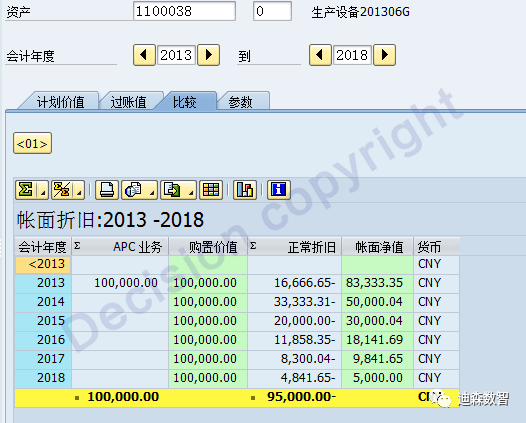

(Case 4) In the SAP system, the depreciation amount realized is basically the same as the table (only a small tail difference):

Attached is the detailed depreciation calculation table in the picture.

[Configuration and enhancement]

The configuration content is relatively simple, but to switch to the straight-line depreciation method for the last two years of the double-declining balance method, you need to enable the enhancement of the SAP system.

Note: After activating EA-FIN in ECC6.0, you need to use the red box BADI enhancement in the picture below. The following four old enhancements have been deactivated:

EXIT_SAPLAFAR_001

EXIT_SAPLAFAR_002

EXIT_SAPLAFAR_003

EXIT_SAPLAFAR_004

Therefore, it is necessary to use the new BADI enhancement to achieve the content in the above picture:

FAA_DC_CUSTOMER

FAA_EE_CUSTOMER

[Thinking questions]

Q: After adopting the double declining balance method, when subsequent capitalization increases the original value or subsequent asset impairment (especially during the mid-year adjustment), how to calculate double balance depreciation? At present, there is no detailed explanation on this in accounting theory circles.

Preliminary suggestion: When the original value of a hundred years is subsequently increased, create a separate sub-asset number and calculate the depreciation amount separately.

Q: The useful life of an asset using the double declining balance method is not an integer. For example, if it is 5 years and 8 months, then it is 8 months. How many years will each be depreciated for accelerated depreciation and straight-line depreciation?

Preliminary suggestion: accelerated depreciation for 3 years and 8 months, straight-line depreciation for 2 years.

Q: After using the double-declining balance method, if an impairment provision is made for an asset, how are accelerated depreciation and straight-line depreciation calculated?

Preliminary suggestion: None. I really can’t guess at this. There is currently no accounting theory guidance.

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Seventeen years of quality, trustworthy!