Time: 2023-10-18

Time: 2023-10-18  Views: 821

Views: 821

[Foreword]

The reason why Decision is highly praised by enterprises during the implementation of digital transformation projects is because experts are escorting Decision during the project process to help enterprises gain new knowledge, grow new capabilities, and improve management during the implementation of digital transformation projects. To improve our vision and reduce project misunderstandings, we have specially set up a "Decision Expert Column" to share with you a series of articles on the implementation of digital transformation projects, so stay tuned.

This article is based on Mr. Yang Yongqing, Decision’s chief financial expert, who has 24 years of rich experience in the field of SAP ERP, and combines the common misunderstandings he found in the implementation of ERP projects to publish corresponding research insights and suggestions to protect your SAP financial implementation and delivery.

[Problem Description]

SAP has developed the IDCN China localized report function for Chinese users. IDCN China localized reports enable the issuance of balance sheets, income statements, and cash flow statements. However, in project implementation applications, most consultants still do not use this standard function and still implement report issuance through ABAP secondary development. As a consultant who has used IDCN reports in projects 11 years ago, this is very speechless. It is necessary to teach everyone how to issue IDCN reports step by step.

[IDCN report advantages]

(1) The balance sheet, income statement, and cash flow statement do not require secondary ABAP opening and configuration;

(2) Report output support: online output, EXCEL output, PDF output

(3) Online viewing supports double-click penetration query details;

(4) Support segment report inquiry (business scope/profit center);

(5) Support foreign currency conversion of legal person statements in different functional currencies;

(6) There is no need to wait for the monthly settlement, reports can be issued 24/7.

[Detailed demonstration]

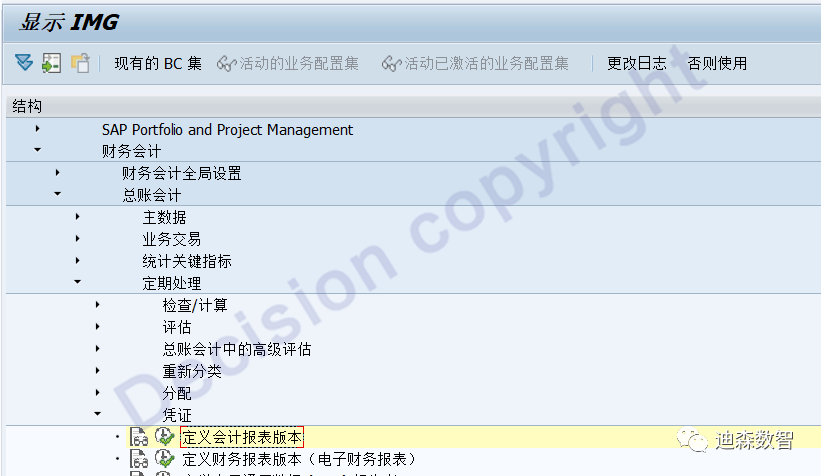

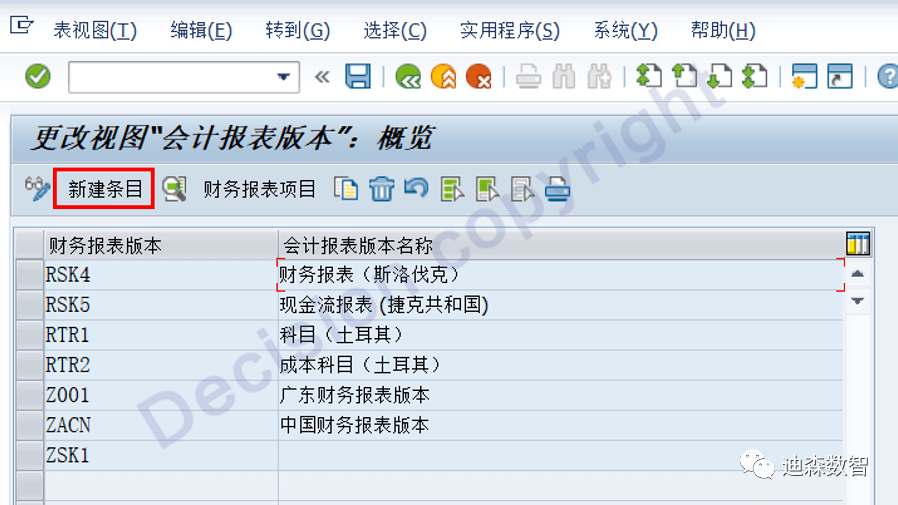

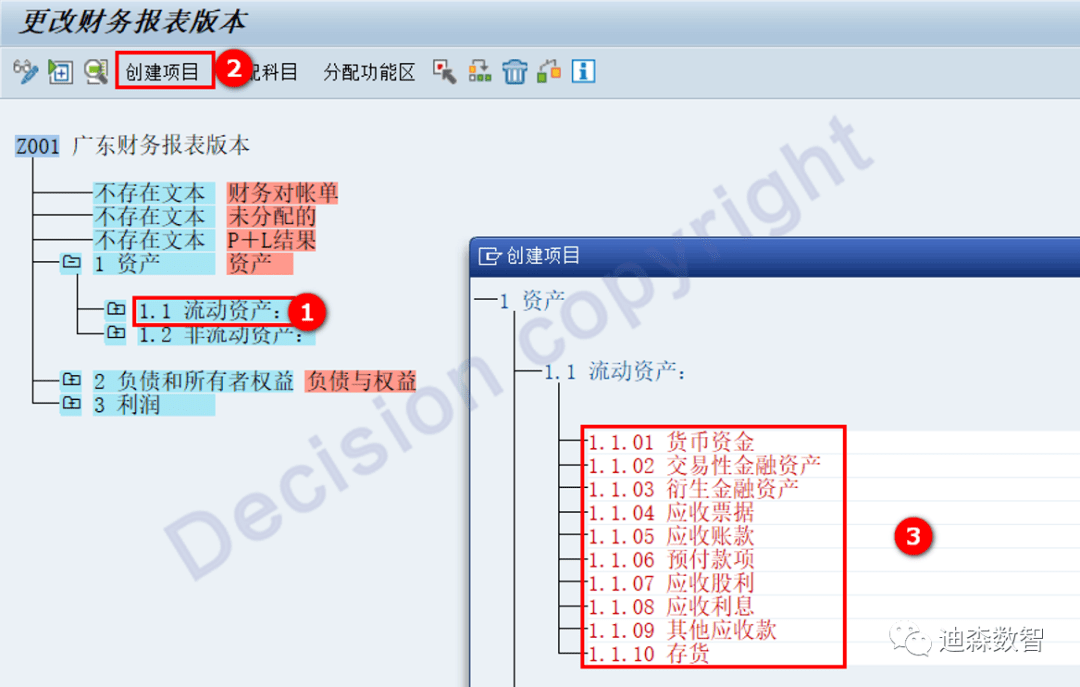

①Define accounting report version

IMG -> Financial Accounting -> General Ledger Accounting -> Periodic Processing -> Vouchers -> Define Accounting Report Version

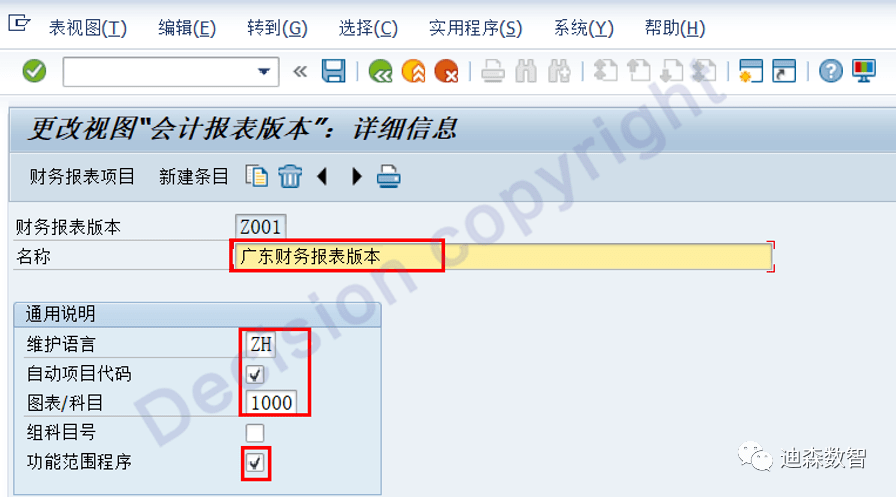

Key points:

Automatic project code: Yes

Chart of accounts: 1000, enter the operating chart of accounts corresponding to the company code

Functional scope procedure: Yes (take the account balance according to the functional scope)

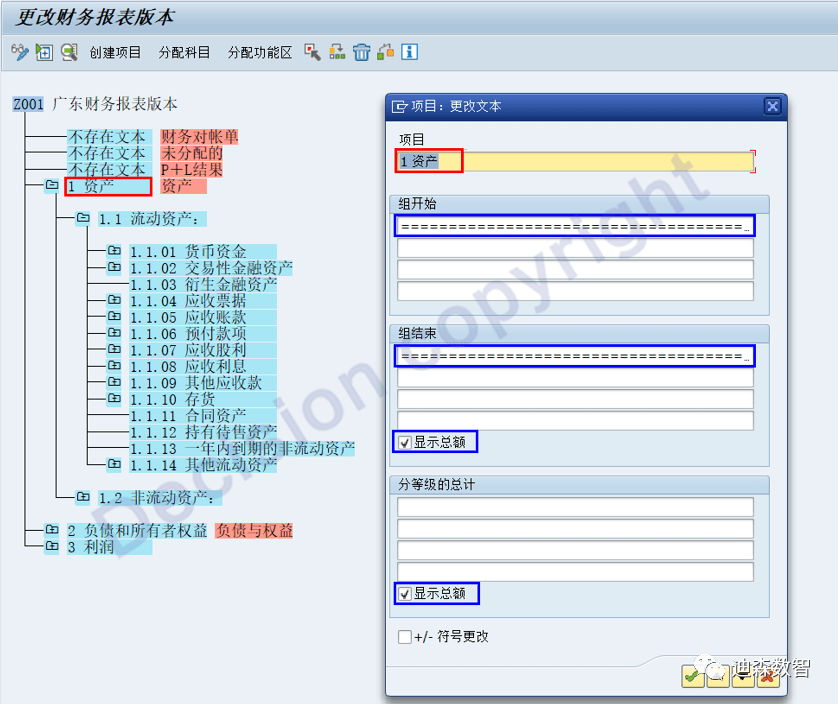

As shown in the picture above, after entering the screen, the system will automatically create several red sub-items. Please do not delete them. These sub-items have specific uses in the SAP system!

Maintain first-level nodes: As shown above, double-click the text corresponding to "Assets" and enter the project name.

My suggestion is: enter 1 asset, that is: the numbered project name; it will be useful later when selecting report items.

The blue box in the above picture can be maintained or not maintained. These contents are not used in China localization reports, but can be used in transaction code F.01

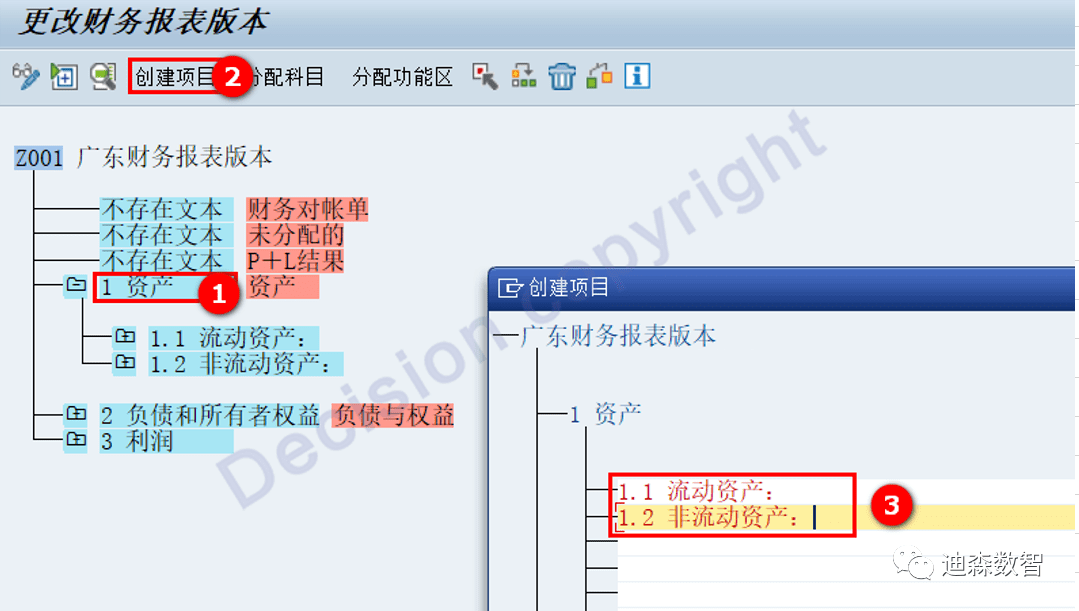

Maintain secondary nodes: as shown above

Maintain third-level nodes: as shown above

Maintain detailed accounts: as shown above

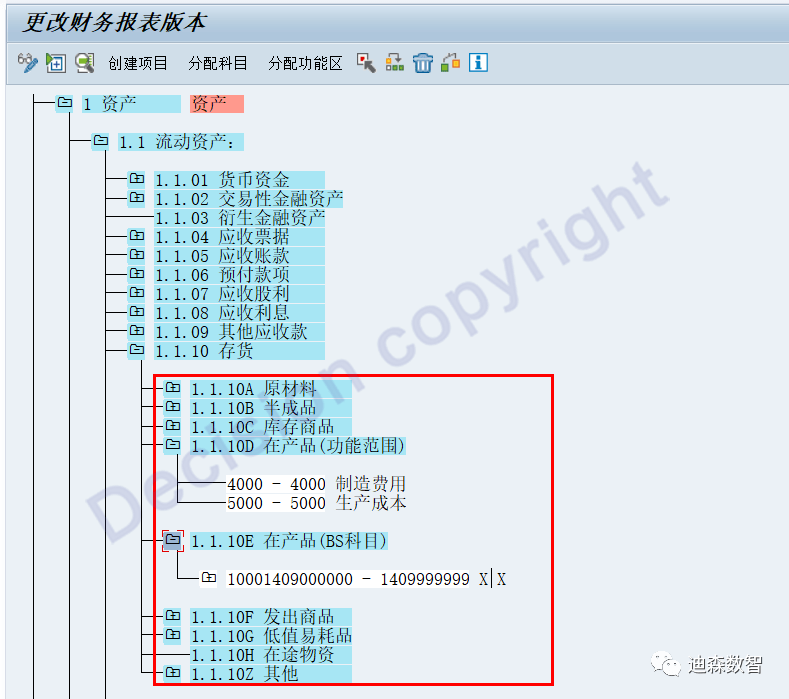

Notice:

D means to get the debit balance, and C means to get the credit balance. It is recommended to select both.

hint:

The first-level, second-level, and third-level nodes are set according to the characteristics of the balance sheet and income statement. They can be set to be thinner than the report items, but not thicker than the report items.

The following are some special third-level nodes. In order to facilitate data verification, the following can be set in more detail:

Example 1: Inventory

A. Inventory generally takes the account starting with 14*, but: considering that daily production work orders have cost balances, it is necessary to set up a node to separately take the amount of the "production cost" functional range to ensure that the balance sheet is balanced in real time, not monthly Balance comes at the end.

In addition: at the end of the product period, it may have been transferred to the asset and liability account, so a separate "Product in Progress BS Account" is set up.

Similar nodes include:

Construction in progress = functional scope (construction in progress) + BS subject construction in progress

Capitalized R&D expenditure = functional scope (capitalized R&D expenditure) + BS account capitalized R&D expenditure

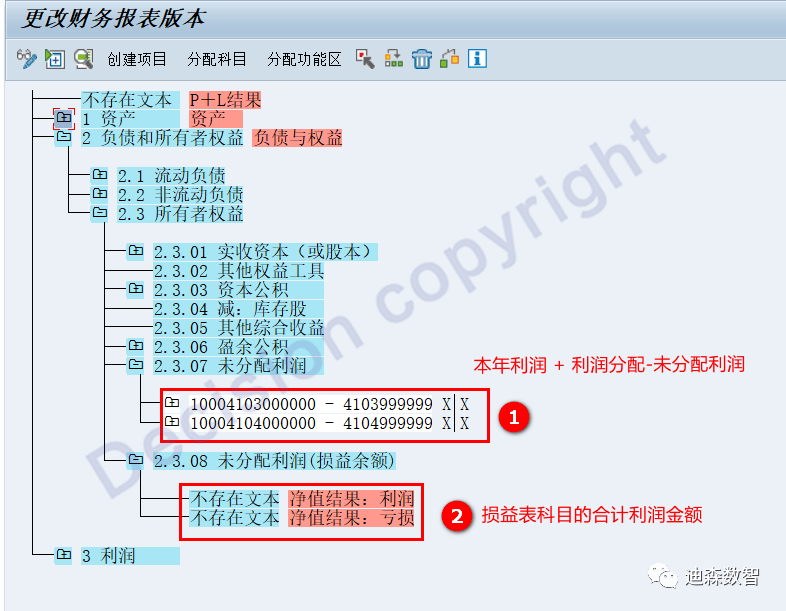

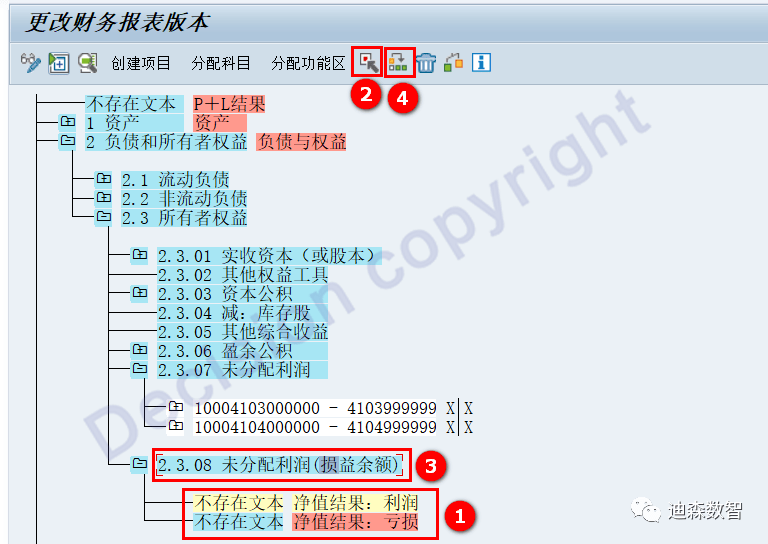

Example 2: Retained profits

[Balance Sheet] Retained Earnings =

(1) Undistributed profit account 4104* balance, 4103* profit for the year

(2) Profit balance for the year (take: net worth result: profit, net worth result: loss)

Note: When the SAP system automatically obtains "net value result: profit, net value result: loss", it will automatically calculate the amounts of "production costs", "manufacturing expenses", "construction in progress" and "capitalized research and development" that have not been carried forward. Inside. Therefore, after "defining the accounting report version", "define the table structure for the financial report", make the corresponding deductions.

Put the two net profit items of the system into the "Undistributed Profit" item, as above.

Continue to define: Income statement items

For income statement items, I usually set them to two nodes.

Note: Management expenses, sales expenses, and R&D expenses are calculated according to functional scope, while others are generally calculated according to accounts.

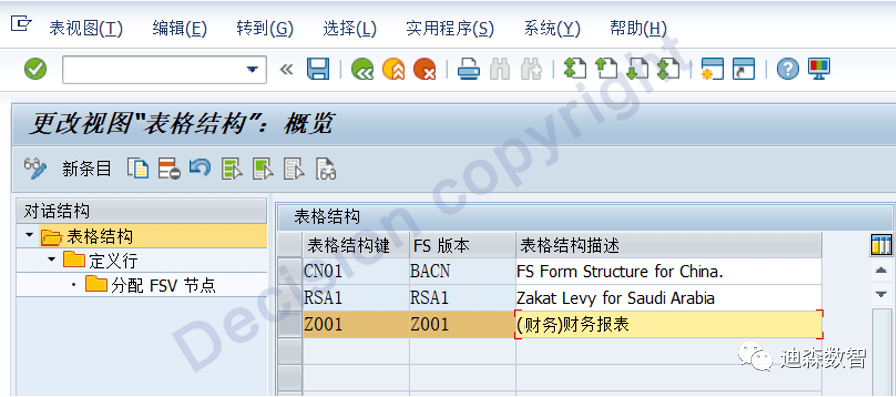

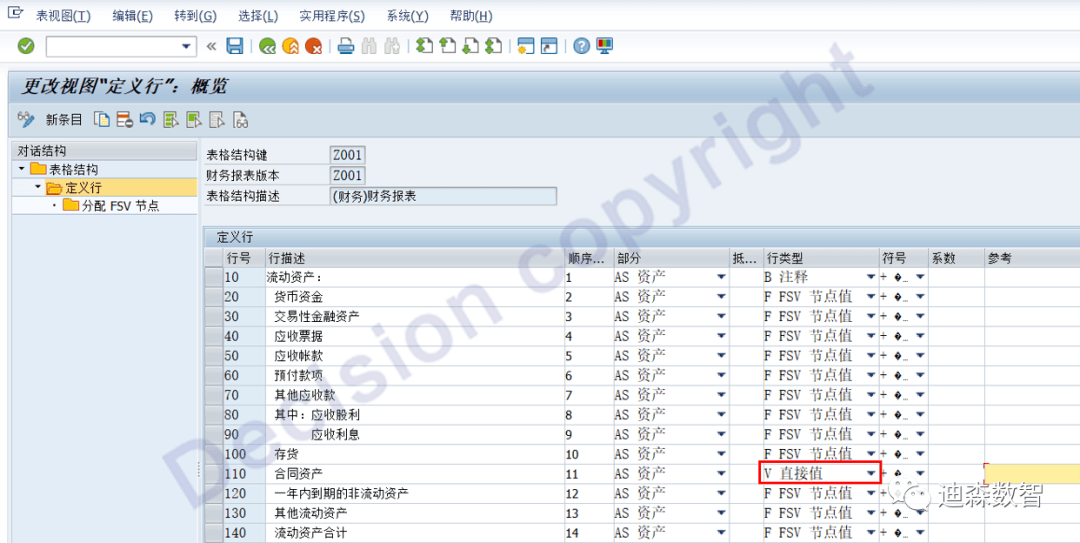

② Define table structure for financial statements

IMG -> Financial Accounting -> General Ledger Accounting -> Periodic Processing -> Reports -> Statutory Reports: China -> Financial Statements -> Accounting Reports -> Define table structure for financial statements

As shown above, create a new report structure and specify the report version created in the previous step.

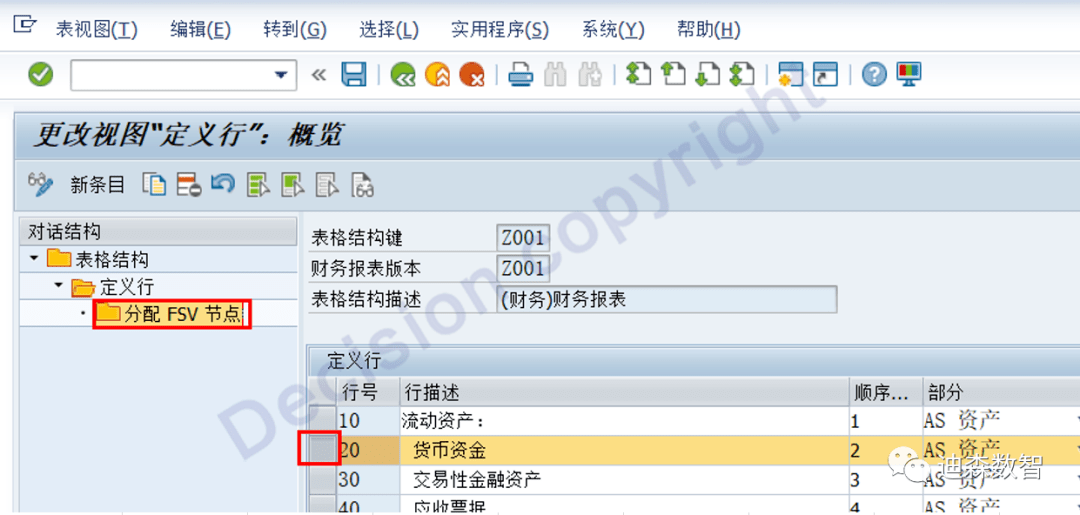

Select a row and click: Define row.

Note:

Line number: The order of the report definition interface, I usually increase by 10;

Row description: the name of the content item in the report;

Order: fill in the order displayed in the report;

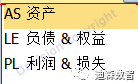

Section: Divide the items in the report into three items, assets, liabilities and equity, profits and losses, and directly specify where the report items are displayed.

Row type: refers to the report item fetching type, F refers to fetching the report version node amount; B comment means that this row does not fetch numbers, only text display;

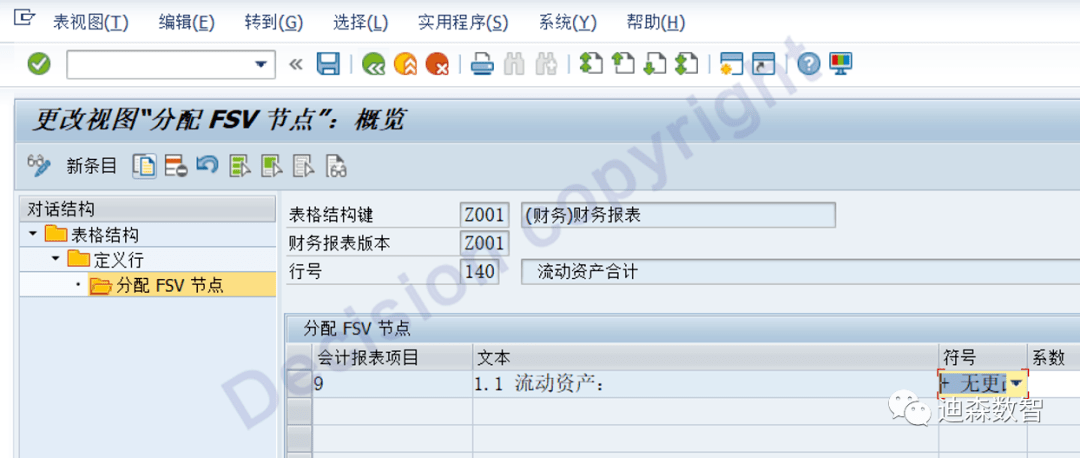

Symbols: + means debit, - means credit. For this interface, I use the + sign. The specific debit can be defined at the next level.

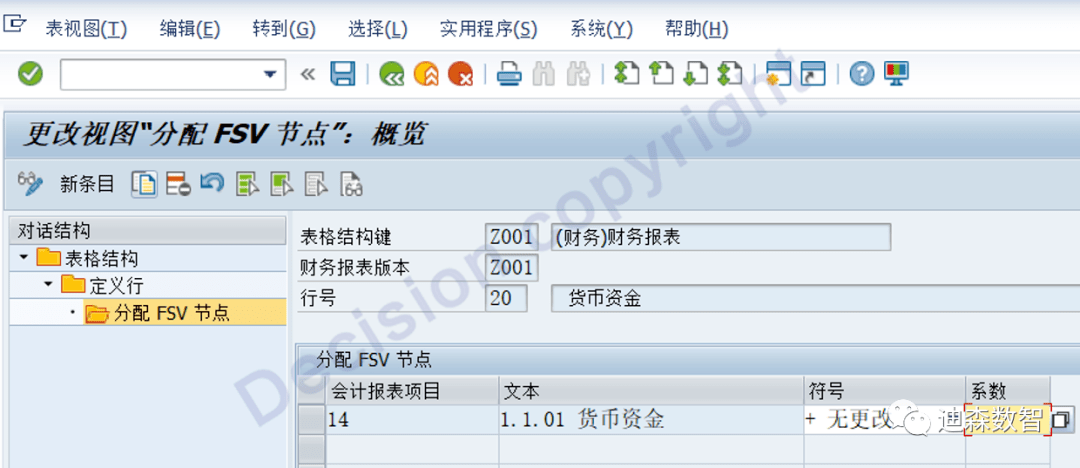

For the report item, specify the node to get the report version, + means to get the debit side.

Click New Entry, and when selecting the report version item, click the text to sort it to make it easier to find nodes.

Here you can see the benefit of manually editing node numbers.

For subtotals and total amounts, the corresponding second-level or first-level nodes can be taken.

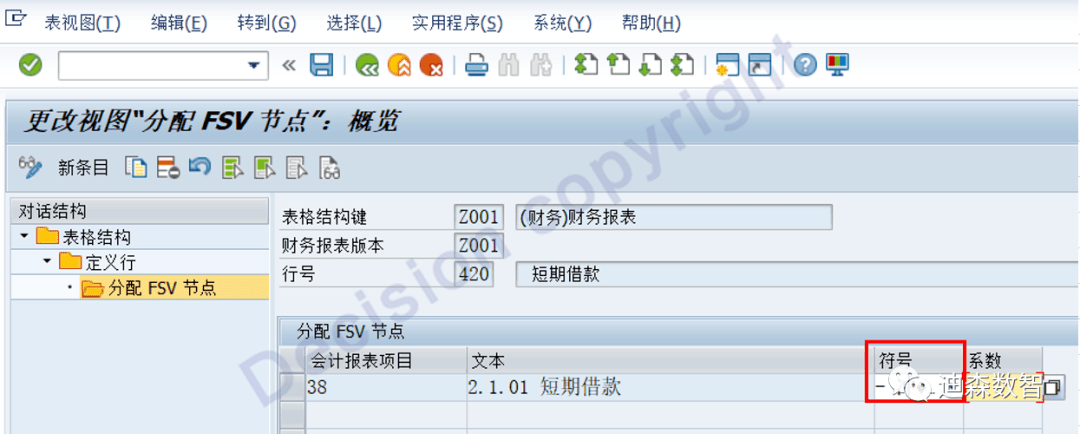

For: liabilities, equity, and income, you need to take the credit, as shown in the figure above.

For operating profit, you need to add up the profit and loss items and take the credit.

Special treatment 1:

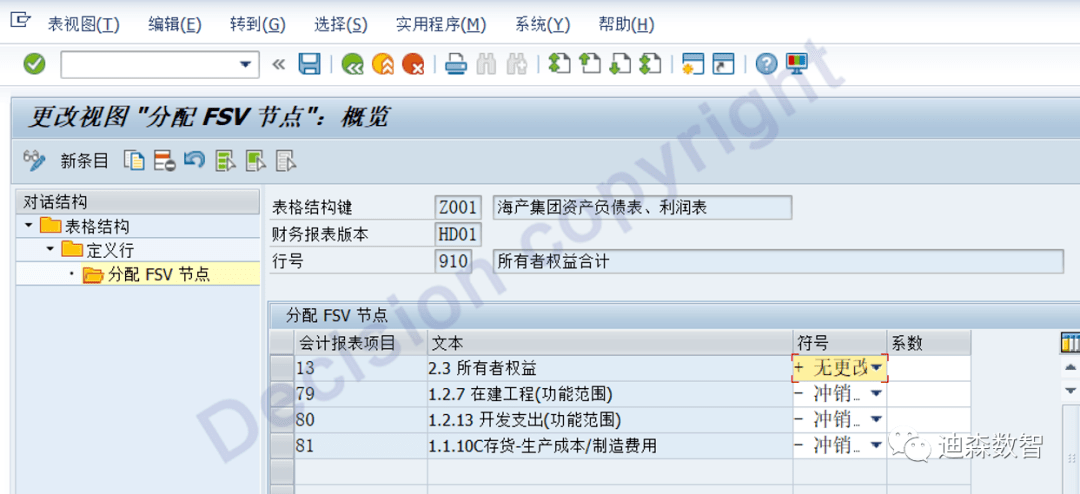

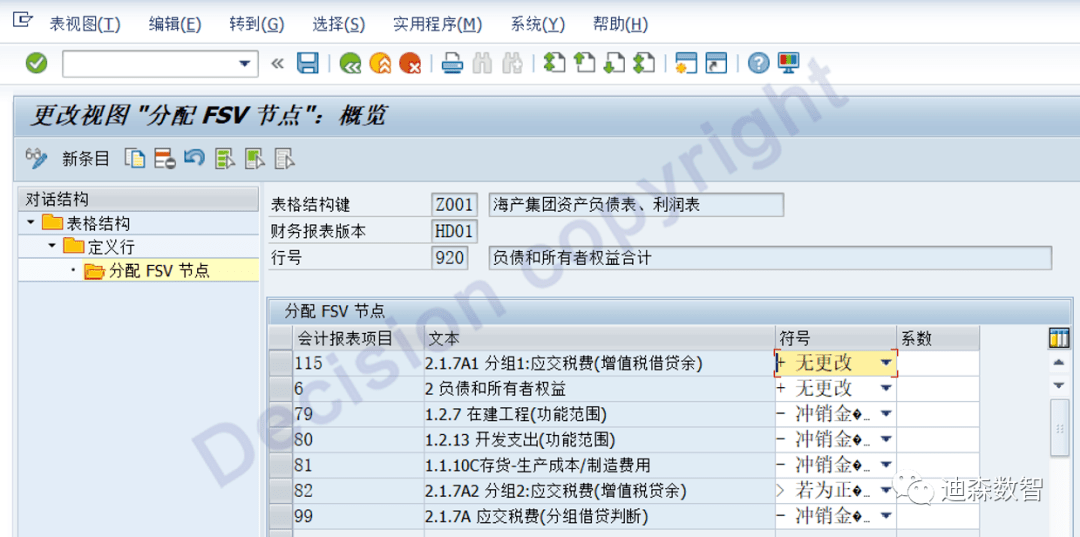

For: undistributed profits, total owners (shareholders) equity, total liabilities and owners (shareholders) equity, you need to deduct when taking the three-level amounts: the functional scope amount that has been listed as an asset! ! !

Undistributed profits = BS account (profit for the year + undistributed profits) + undistributed profits (automatic profit items of the two systems) – already displayed in other columns of assets and liabilities: (in the functional scope) construction in progress and development expenditures , Products in progress, these contents are usually calculated through the CO profit and loss account, and are carried forward to the BS assets and liabilities account at the end of the month. Deductions must be made here to avoid duplication.

It is worth noting that: (in the functional scope) projects under construction, development expenditures, and products in progress, the corresponding carry-over accounts must also fill in the corresponding functional scope, otherwise the data will be uneven!!!

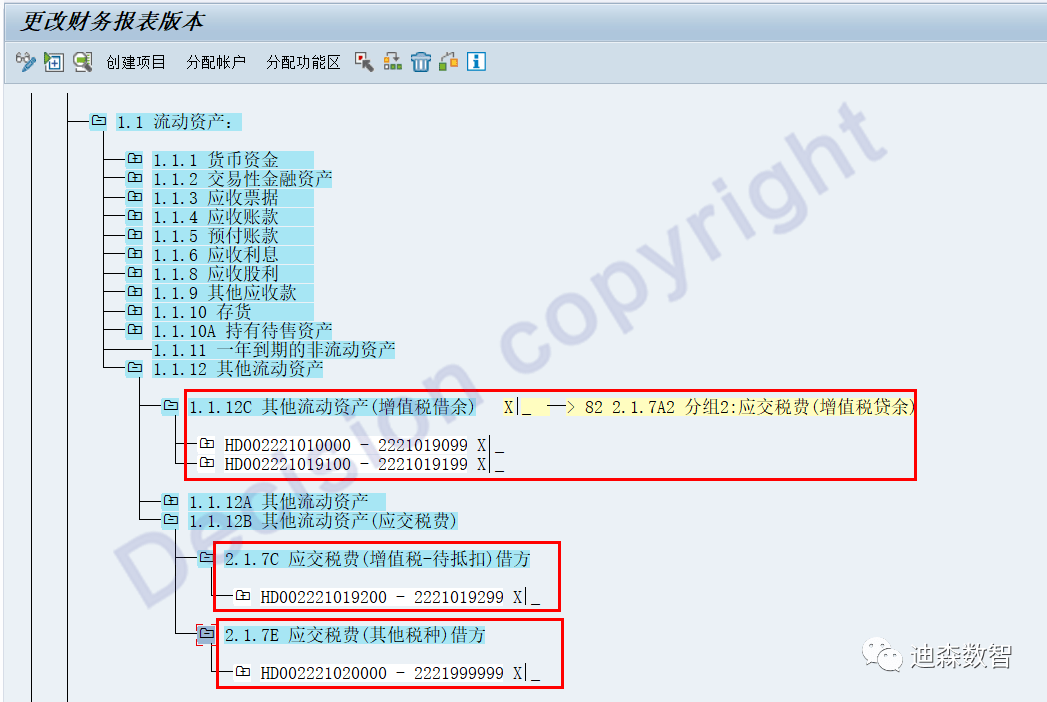

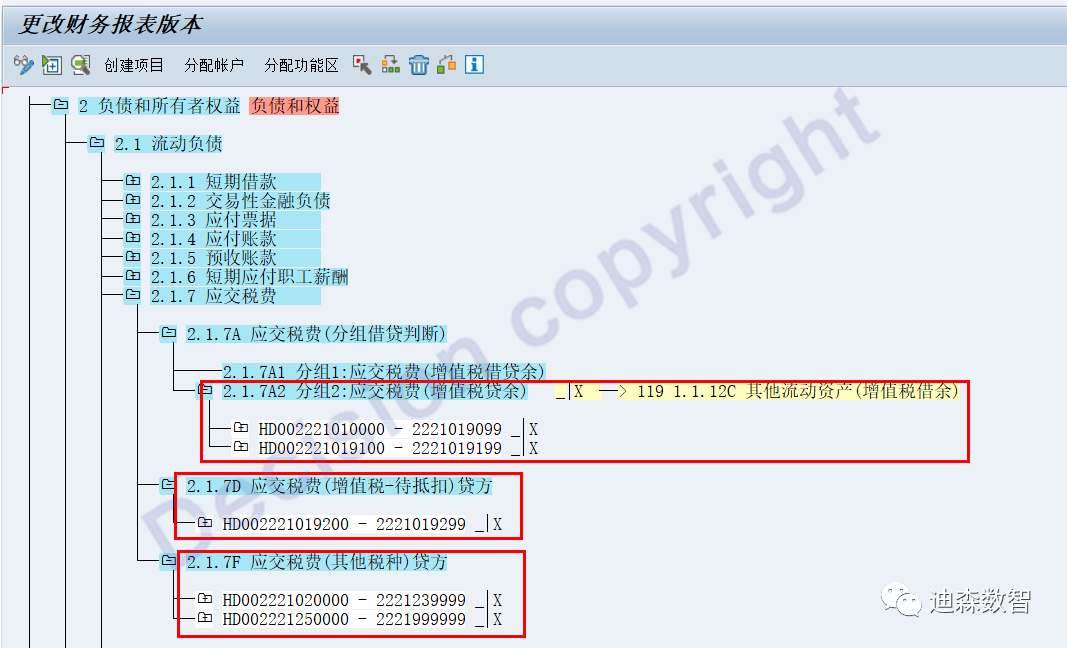

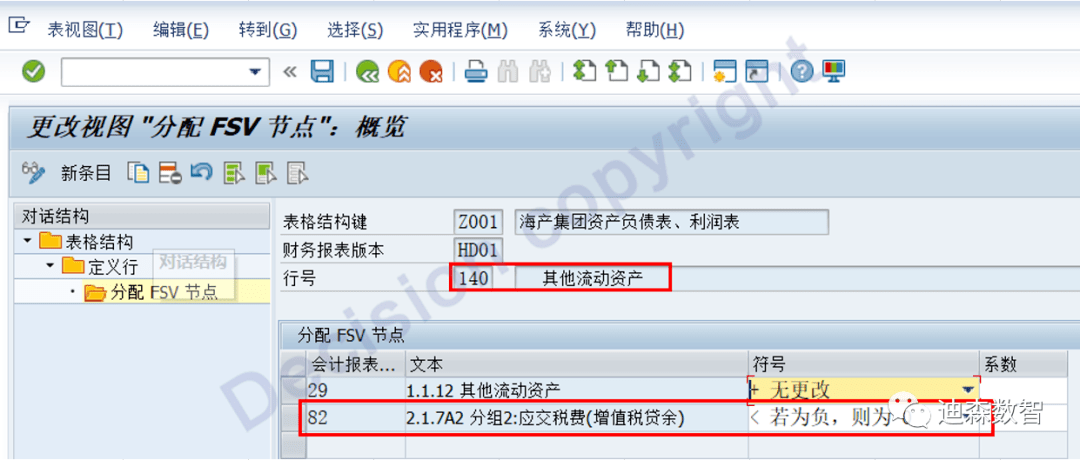

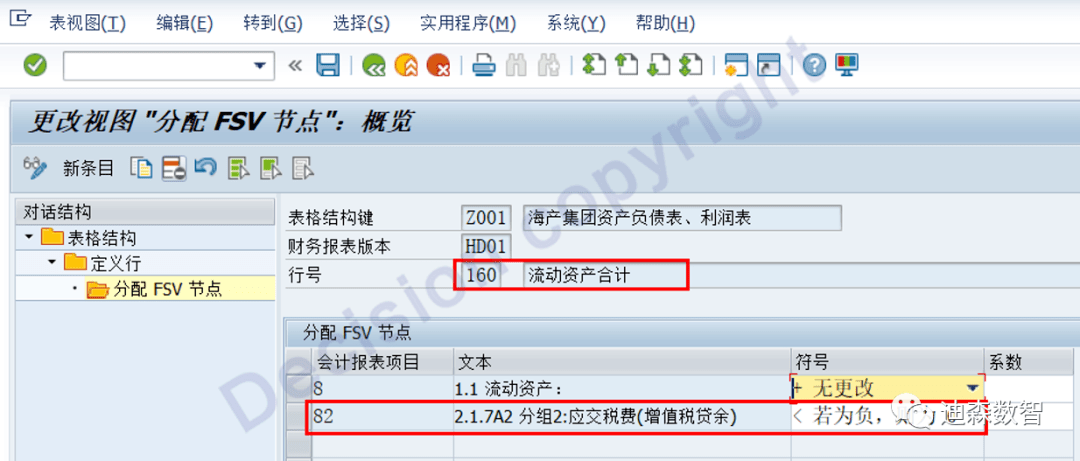

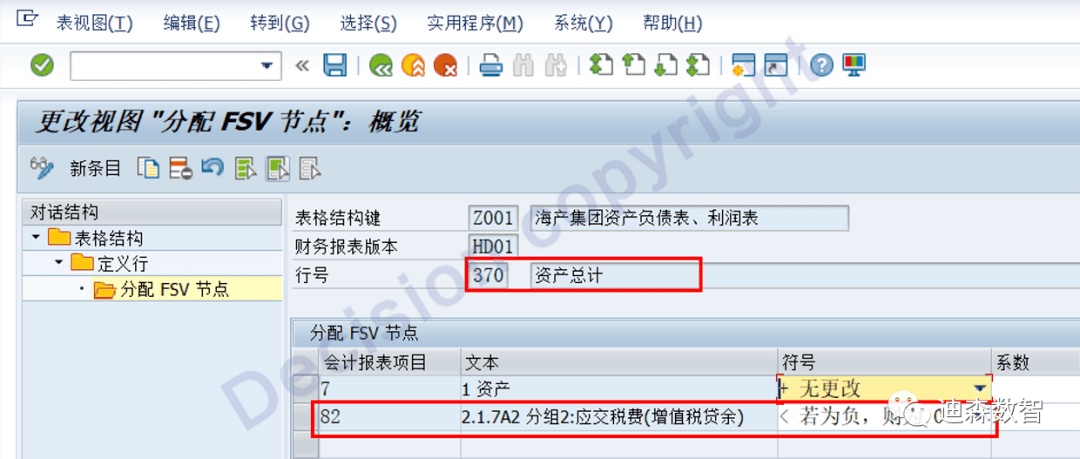

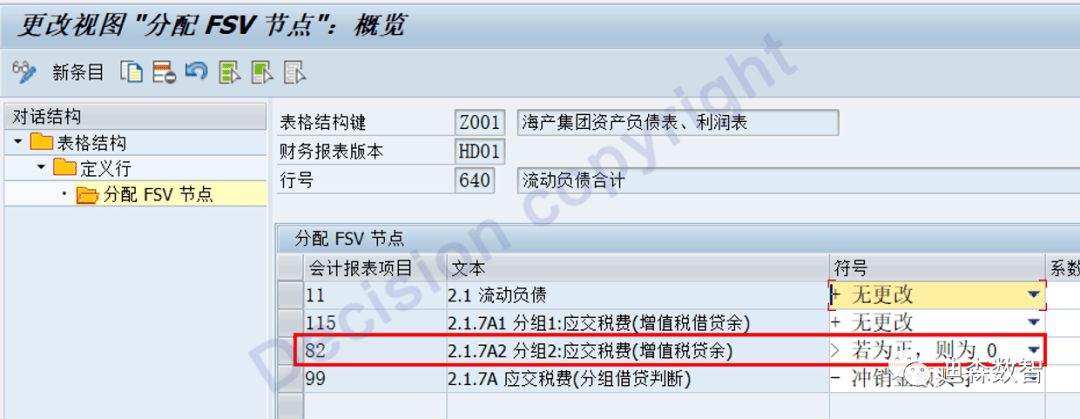

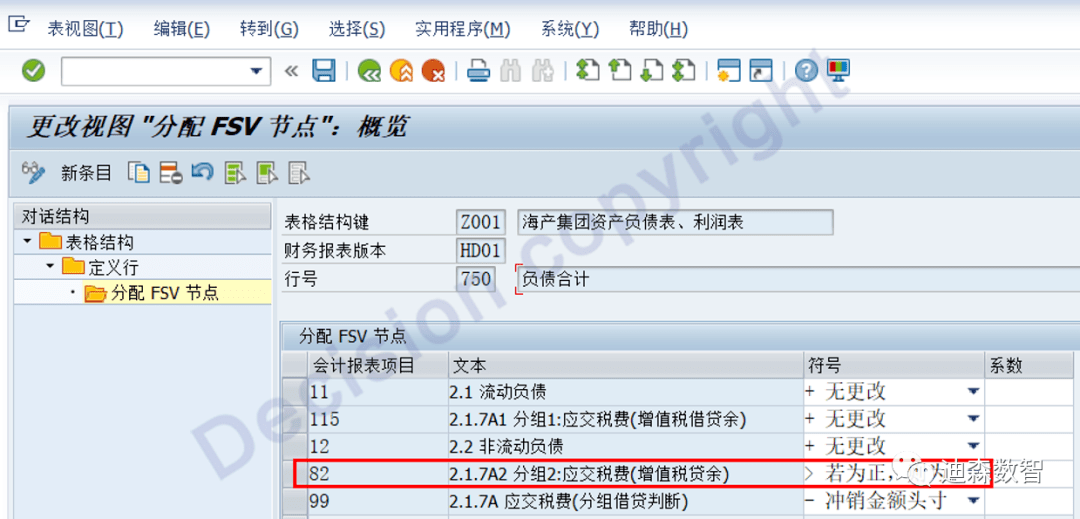

Special treatment 2:

For taxes payable, according to the audit opinion, the credit balance of a single tax type is presented in the liability direction, and the debit balance is presented in the asset direction:

A. Divide the tax payable accounts into loan directions according to tax types, and subdivide the access nodes in other current assets and liabilities payable taxes respectively.

When displaying assets in the direction, the values need to be adjusted at three levels: other current assets, total current assets, and total assets.

When presenting in the direction of liabilities, it is necessary to adjust the figures at four levels: taxes payable, total current liabilities, total liabilities, total liabilities and owners' equity.

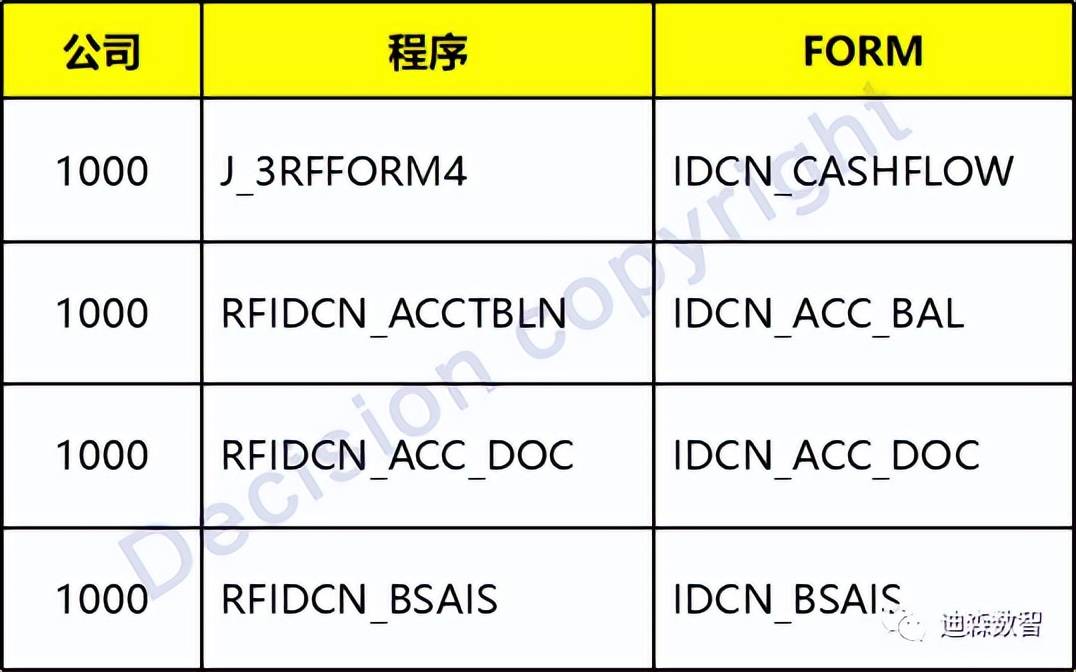

③Define the output PDF table

IMG -> Financial Accounting -> General Ledger Accounting -> Periodic Processing -> Reports -> Statutory Reports: China -> Financial Statements -> Assign PDF Form to Program

IDCNBSAIS - Financial statements (China) can be output in PDF format when used, and SAP also presets the corresponding FORM format. It needs to be set and allocated before use.

(1) Configuration

IMG -> Financial Accounting (New) -> General Ledger Accounting (New) -> Periodic Processing -> Reports -> Statutory Reports: China -> Financial Statements -> Assign PDF Forms to Programs

(2) View or modify FROM format (transaction code SFP)

Before using transaction code: Adobe liveCyde Designer 8.0 (applicable to GUI720/730) needs to be installed.

(3) Before outputting in PDF format, BASIS needs to be processed according to NOTES 685571.

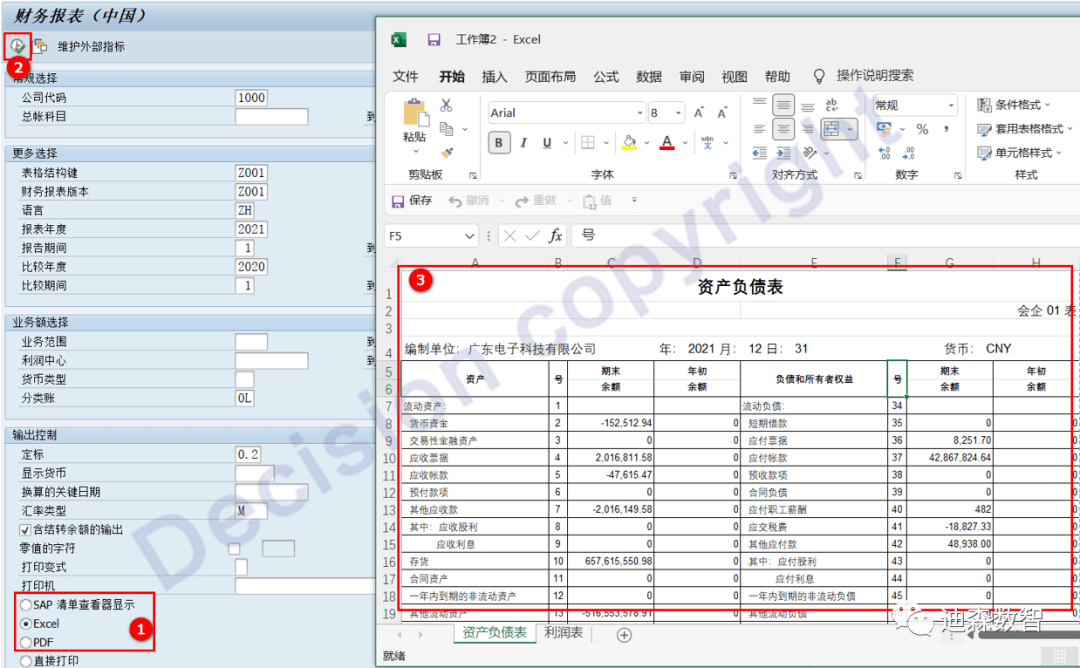

④Report output at the front desk

Transaction code IDCNBSAIS

Accounting -> Financial Accounting -> General Ledger -> Period Processing -> Closing -> Reports -> General Ledger Reports -> Financial Statements/Cash Flow -> China -> Financial Statements

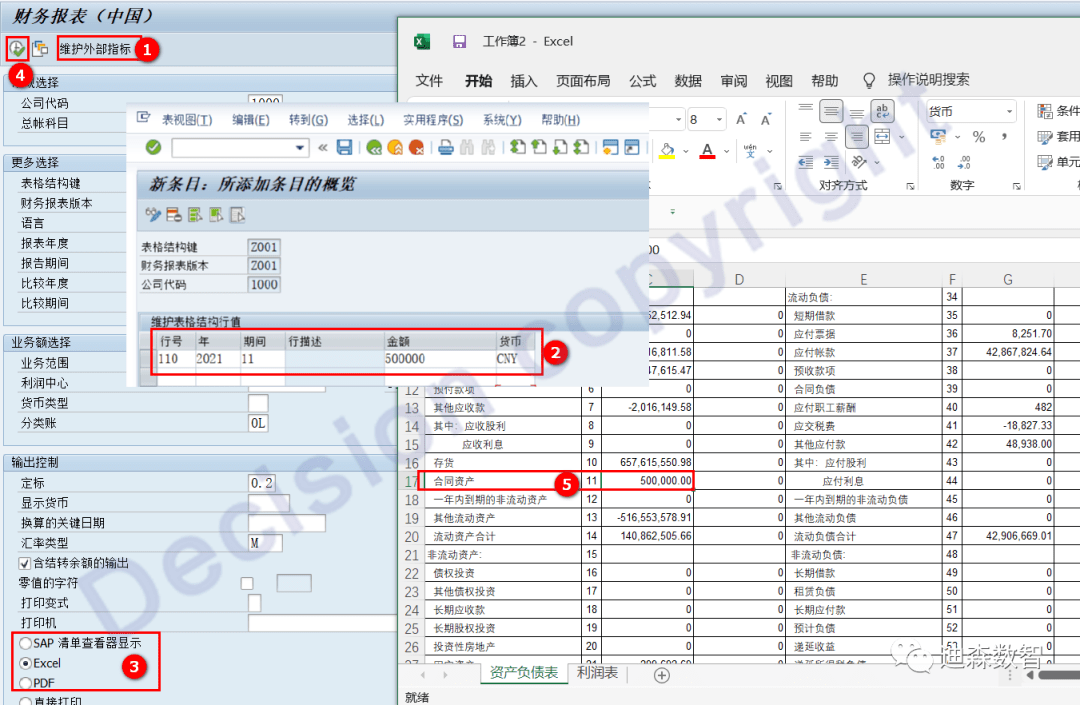

⑤ Manually enter report disclosure items

Specify the corresponding report item as a V direct value

In the report screen, click: Maintain external indicators, enter the indicators and save them, and then you can view them in the report.

For example: amount of mortgaged assets, mortgaged notes, number of R&D personnel, etc.

[IDCNBSAIS-Financial Statements (China) Other Frequently Asked Questions]

In the IDCNBSAIS financial statements, the balance sheet and income statement are often uneven in the test system ("Assets <> Liabilities & Equity", "Ending Undistributed Profit <> Undistributed Profit Account Balance + Income Statement Profit"). Common problems are:

(1) After creating a new account, the new account is recorded in the previous year, and the annual carryover of the account balance is not re-implemented;

(2) The newly created account does not specify the fetching position in the financial statement version;

(3) The balance of the temporary transition account is not 0, and the fetching position is not specified in the financial statement version: such as previous year's profit and loss adjustment, opening data import;

(4) The 66* accounts of management expenses, sales expenses, and manufacturing expenses are calculated according to functional scope. The corresponding functional scope is not specified when the voucher is generated;

(5) Set up accounts within the scope of special accounting functions such as: "5001*Production Cost" "5301*R&D Expenditure". Accounting should not include: administrative expenses, manufacturing expenses, sales expenses, etc.;

(6) The set function range is 1000/2000/3000/4000/5000. When creating the voucher, the SAP sample function range 0100 was used, and the 0100 function range fetching logic was not set when fetching the report;

(7) Only the profit and loss account is entered into the functional scope, but a small number of balance sheet accounts are entered into the functional scope, resulting in duplication or omission of numbers in the report;

(8) After the account accounting has the occurrence amount, the account is forcibly deleted, or the account configuration is retransmitted from the DEV 100 system, and some of the imported accounts are lost or deleted.

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Seventeen years of quality, trustworthy!